This week, a deep dive into holiday shopping predictions and how AI chatbots are helping customers with search. Also, Pinko’s Milan AR activation, earnings to know and executive moves.

This holiday season is on track to be the biggest yet. Adobe’s analytics division’s September 24 report projects $240.8 billion in U.S. online spending, a jump of 8.4% from last year.

Electronics, apparel and home goods will lead this surge, said Vivek Pandya, Adobe Digital Insights’ Lead Analyst. “In a constrained economic environment, we’re seeing consumers willing to trade up, focusing their spending on more meaningful, quality gifts this season,” he said.

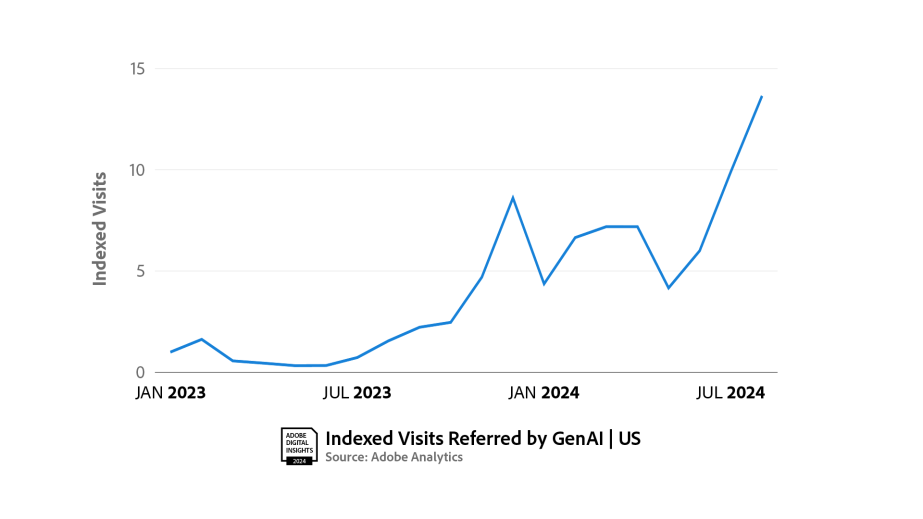

One of the most compelling stories this holiday season is the rise of AI chatbots as virtual shopping assistants. According to Adobe, traffic from chatbots like ChatGPT to retail sites has doubled in 2024, with traffic from referral links now eight times higher than last year.

Simon Langevin, vp of product at Coveo, emphasized the role of AI. “In fashion, Gen AI-powered gift finders can transform holiday shopping by offering personalized, conversational experiences that simplify decision-making and drive impulse buying,” he said.

Coveo’s September 12 report found that nearly one-third (31%) of all shoppers, and a significant 44% of millennials, see AI-guided gift shopping as helpful. Chatbots are no longer just tools for answering basic customer service inquiries; they now offer tailored recommendations and real-time suggestions, helping shoppers sift through extensive catalogs and assemble outfits.

“These tools can tailor recommendations based on style preferences, helping shoppers quickly discover the perfect gift,” Langevin said. “By reducing choice overload and offering real-time suggestions, they create a sense of urgency and confidence in purchases.”

Eighty-five percent of shoppers surveyed by Coveo admitted to impulse-buying online, with fashion, shoes, and apparel topping the list of categories. Retailers that leverage AI effectively can tap into these impulsive tendencies, offering curated suggestions that not only drive sales but also keep customers coming back.

While inflation and economic concerns are affecting shoppers, an interesting trend is taking shape: Consumers are “trading up” to more expensive items, even in fashion. “In categories like electronics, the ‘trading up’ phenomenon is starting to seep into fashion, as consumers prioritize quality and longevity over sheer volume,” said Pandya. Multi-brand fashion retailers are expected to see 5.8% year-over-year sales growth this season, to $43.9 billion — a significant leap from the 1.7% growth in 2023.

Pandya also highlighted the strategic importance of early-season discounts. “Retailers are leveraging early promotions to capture demand ahead of traditional shopping days, and this year, Cyber Monday will essentially become the ‘last call’ for the best deals,” he said. Adobe’s report notes that discounts beginning at 16% off in October will escalate to 18% in November, building up to Cyber Week. This extended promotional period allows retailers to manage margins while still enticing shoppers, particularly as 90% of consumers are open to being influenced to add items to their online orders.

John Mercer, head of global research at Coresight Research, said retailers should take advantage of Amazon’s second Prime Day in October to set themselves up for holiday success. “Such events resonate with consumers, encouraging the pull-forward of demand and impacting traditional days like Black Friday and Cyber Monday,” he said.

In an increasingly digital shopping environment, social influencers continue to wield significant power. Adobe’s report shows that influencer-driven traffic converts at a rate 10 times higher than general social media traffic. “Influencers are now a fundamental part of the holiday marketing strategy,” said Pandya. “Retailers should prioritize building relationships with those who can recommend products or offer custom promo codes to their followers.”

While influencer marketing growth is outpacing traditional advertising, paid search remains a top driver of retail sales.

Coveo’s survey shows that 80% of consumers discover special offers through digital sources like social media, online marketplaces and email, highlighting the need for a strong online presence.

This year marks a shift in holiday shopping, with mobile set to capture 53.2% of overall holiday spending. Pandya underscored the importance of personalization in mobile shopping, in particular. “That’s especially in fashion where impulse purchases are common,” he said.

Mobile’s dominance aligns with the rising popularity of buy-now, pay-later options, which are expected to reach $18.5 billion this season. Over 74% of BNPL purchases are happening on mobile devices, reinforcing the need for a seamless, user-friendly mobile shopping experience.

Pinko’s AR handbag activation at Milan Fashion Week

Italian fashion brand Pinko partnered with the WeAR AR Fashion Festival for a different type of Milan Fashion Week activation. The Festival launched in New York with Balmain on September 6, before moving to London, Milan and Paris. It is aimed at bringing the fashion industry closer to augmented reality technologies in real life and to give brands a new way to showcase their new collections during fashion month.

“At Pinko, we’ve always been early adopters of innovation, whether it’s experimenting with augmented reality, NFTs or digital twins. The WeAR AR Fashion Festival is a natural extension of our efforts to push the boundaries of how consumers experience fashion,” said Marco Ruffa, CMO and Digital Transformation Director at Pinko.

The brand’s handbag-focused AR activation, part of the Milan leg of the festival that ran from September 17-23, brought Pinko’s Love Bag to life. Using geo-located AR, consumers could virtually explore the bag, engage with its details up close and connect with the brand through social buttons in the AR experience. Geo-located AR is a technology that overlays digital content onto real-world locations, allowing users to experience interactive elements specific to their geographic position through their devices.

“The AR element allowed us to create narratives that bridged the gap between physical and digital realms,” Ruffa said, “These immersive experiences also offer activations without physical waste. … AR speaks to our belief in fashion as an experience, not just a product, and reinforces our drive to push boundaries while maintaining a playful yet sophisticated brand image.”

“Luxury customers seek not just products but memorable interactions,” said Ruffa. For its part, Tiffany’s hosted an AR experience at the U.S. Open in August.

“AR is exciting, but if not used thoughtfully, it can become more of a gimmick than a tool for enhancing the story behind our collections,” said Ruffa. “I prefer to focus on using AR to deepen the emotional connection between the consumer and the brand, ensuring that the digital elements feel like an extension of our physical products, not a distraction.”

While Milan’s event has concluded, the festival’s Paris edition is happening now, scheduled to wrap up on October 1. It features creative production company Sawhorse Productions and graphic tattoo artist Jeferson Araujo.

Pinko last reported revenue of approximately $299.25 million and an EBITDA of $60.9 million in 2022. The company aims to reach $525 million in annual sales between 2025 and 2026.

Earnings to know

- On September 26, H&M Group reported flat sales in the U.K. and key European markets for the third quarter, with global net sales slipping 3% to SEK 59 billion (approximately $5.3 billion). While sales in local currencies were flat, gross profit improved slightly to a 51.1% margin. CEO Daniel Ervér attributed slow sales in June to cold weather but noted a recovery in July and August, with September sales expected to rise by 11%. Despite the challenging environment, including competition from Inditex, H&M remains focused on strengthening its brand through product investments, enhancements to the shopping experience, and improved marketing. However, the group revised its outlook, now expecting an operating margin below 10% for the year.

- Stitch Fix’s recent earnings reveal a company amid a strategic transformation under CEO Matt Baer. The good news includes positive adjusted EBITDA for seven consecutive quarters, expanded gross margins in FY24, and a strong balance sheet with $247 million in cash and no debt. The company’s strategic efforts, like optimizing pricing, enhancing AI tools, streamlining its assortment and reimagining client experiences, have shown initial success, with a 5% uplift in conversion from the new StyleFile feature, for example. However, the company faces challenges, including a 16% decline in FY24 net revenue, a 20% drop in active clients and ongoing headwinds from a difficult retail environment. Stitch Fix is cautiously optimistic, expecting revenue growth to return by FY26 while continuing to focus on strengthening its client experience and improving cost efficiency.

Executive moves

- Christopher de Lapuente, chairman and CEO of LVMH’s selective retailing division, will retire on October 31, with his responsibilities transitioning to Stéphane Bianchi who was moved to LMVH’s group managing director role in March.

- De Beers Group has appointed Sally Morrison as the Natural Diamonds Lead in the U.S., where she aims to promote the unique, authentic appeal of natural diamonds to the next generation of consumers. She has a background in leading marketing campaigns for organizations including the Diamond Producers Association, the World Gold Council and Gemfields, and has worked with De Beers Group in various roles since 2002.

Inside Glossy’s coverage

Other news to know

link